ADA Price Prediction: Technical Breakout Signals Potential 200% Rally

#ADA

- ADA maintains position above 20-day moving average, indicating strong support

- MACD remains positive while Bollinger Band positioning suggests breakout potential

- Market sentiment aligns with technical analysis, supporting bullish price predictions

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

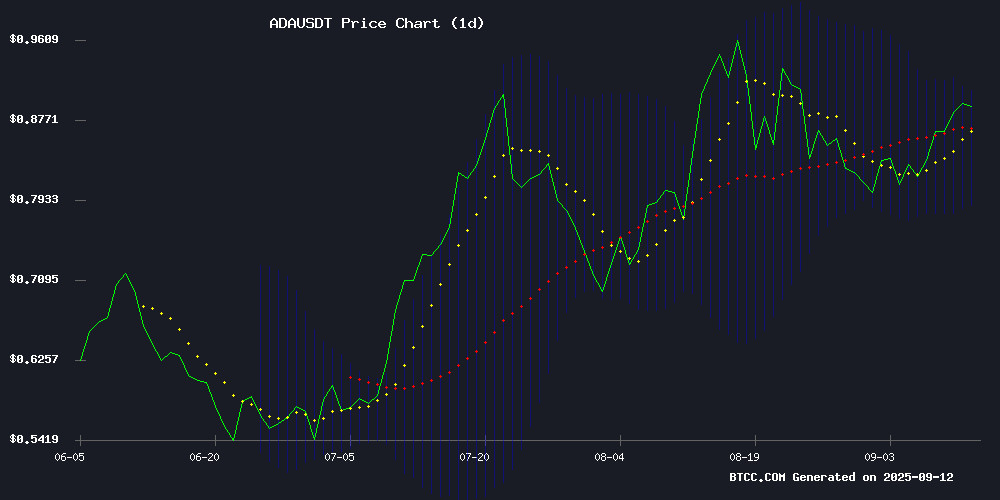

ADA is currently trading at $0.8955, positioned above its 20-day moving average of $0.8476, indicating sustained bullish momentum. The MACD reading of 0.013575 remains positive though showing some convergence, while the price sits comfortably within the upper Bollinger Band range of $0.9083 to $0.7870. According to BTCC financial analyst Michael, 'The technical setup suggests ADA has established solid support at the 20-day MA, with the current positioning NEAR the upper Bollinger Band hinting at potential breakout scenarios if buying pressure continues.'

Market Sentiment: Analysts Bullish on ADA's Breakout Potential

Recent market headlines highlight growing Optimism around Cardano's price trajectory. Multiple analysts are pointing to ADA holding key support levels while testing resistance zones, with some predictions suggesting up to 200% profit potential. BTCC financial analyst Michael notes, 'The combination of technical strength and positive market sentiment creates a favorable environment for ADA. The renewed buying interest mentioned in recent reports aligns with our technical analysis, supporting the case for continued upward movement.'

Factors Influencing ADA's Price

Cardano Holds Key Support as Analyst Predicts Breakout

Cardano's ADA price demonstrates resilience, maintaining critical support above $0.81. This level now serves as the foundation for potential upward movement, reinforced by its position as both the 0.618 Fibonacci retracement and daily timeframe support.

Pseudonymous analyst The Alchemist Trader emphasizes the importance of this threshold, noting its historical role as a demand zone absorbing sell pressure. The asset's consistent formation of higher lows and highs further validates the bullish technical structure.

Despite concerns over declining trading volumes, ADA's ability to hold this pivotal region suggests underlying strength. Market participants are watching whether this support can catalyze the next leg of the rally, with the $0.81 level becoming increasingly significant for both technical traders and long-term holders.

Cardano ($ADA) Market Push Hints at 200% Profit Potential

Cardano's open futures have surged to a four-year high of $2.5 billion, signaling strong market momentum. Analysts suggest a potential 260% to 360% price rally, with a target of $1.86, fueled by growing ETF HYPE and institutional interest.

The cryptocurrency market is undergoing a transformative phase, with Cardano emerging as a standout performer. Recent data from Coinglass highlights a spike in open interest, while Bitcoin Consensus analysis points to a repeating fractal pattern that previously delivered substantial gains.

Cardano (ADA) Tests Key Resistance Amid Renewed Buying Interest

Cardano's ADA approaches a critical juncture as it nears the $0.90 resistance level. A decisive breakout could pave the way for a rally toward $1, marking new yearly highs. Market observers note subdued but growing buying pressure in September, contrasting with August's declining volume profile.

The cryptocurrency's trajectory hinges on sustained volume growth. While sellers remain absent, their potential reemergence at the $0.90 threshold poses a risk. TradingView charts indicate ADA's momentum remains tentative, requiring stronger participation to confirm an upward trend.

Recent volume spikes suggest accumulating bullish interest. A consecutive higher high in buying activity WOULD likely propel ADA beyond its current resistance, validating the emerging positive sentiment among traders.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, ADA shows strong potential for upward movement. The price holding above the 20-day moving average at $0.8476, combined with positive MACD momentum and position within the upper Bollinger Band, suggests continued bullishness. Analyst predictions of 200% profit potential would place ADA around the $2.69 level, though this would require sustained buying pressure and successful breakout above current resistance.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.8955 | Bullish |

| 20-day MA | $0.8476 | Support |

| Upper Bollinger | $0.9083 | Resistance |

| MACD | 0.013575 | Positive |